Revised Rates of 7th CPC Allowances get reflected in the current month’s Salary Bills – PIB Report

The Central Government’s decision on recommendations of the 7th Central Pay Commission (CPC) on Allowances published in Gazette of India yesterday i.e. 6th July, 2017; All allowances are given effect from 1st July 2017;

Concerned Ministries advised to issue their Orders on Allowances governed by them immediately so that the revised rates of allowances get reflected in the current month’s Salary Bills of the Government employees

Resolution conveying the Central Government’s decision on recommendations of the 7th Central Pay Commission (CPC) on Allowances has been published in Gazette of India yesterday i.e.6th July, 2017.

Based on the Report of Committee on Allowances (CoA) and the recommendation of E-CoS, the Cabinet had earlier approved the modifications in 34 Allowances in its Meeting held on 28th June 2017.

All allowances are given effect from 1st July 2017.

Concerned Ministries have now been advised to issue their Orders on Allowances governed by them immediately so that the revised rates of allowances get reflected in the current month’s Salary Bills of the Government employees.

Major Highlights of the Allowances approved by the Union Cabinet are as follows:

Cabinet approved recommendations of 7th CPC on allowances with 34 modifications – revised rates effective from 01.07.2017

It will benefit 34 lakh Civilian employees and 14 lakh Defence Forces personnel

7th CPC examined 197 allowances, recommending abolition of 53 allowances and subsuming 37 in others.

7th CPC recommended revised rates commensurate with Dearness Allowance

Fully DA-indexed allowances – no raise, not DA indexed raised by 2.25, partially indexed raised by 1.5, % based rationalised by 0.8

Risk & Hardship Matrix evolved for allowances linked to risk and hardship

7th CPC projected additional financial implication at Rs.29,300 cr per annum, modifications to have additional implication of Rs.1448.23 cr

Combined additional financial implication estimated at Rs.30748.23 crore per annum.

1. Number of allowances recommended to be abolished and subsumed: Government decided not to abolish 12 allowances in view of specific functional requirements 3 of 37 subsumed allowances will continue as separate identities due to unique nature of these allowances.

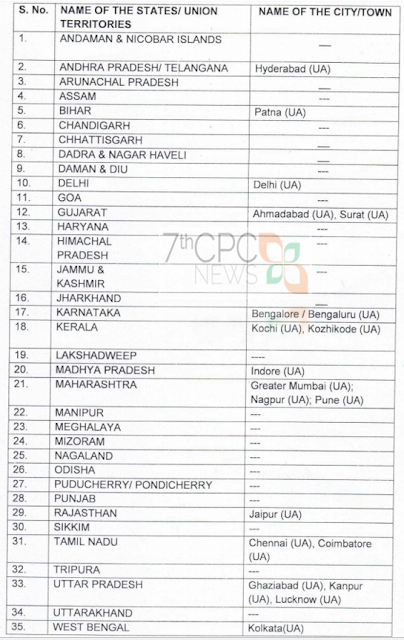

2. House Rent Allowance (HRA) : HRA will be paid @24%, 16% & 8% for X, Y & Z cities respectively HRA not to be less than Rs.5400, 3600 & 1800 for X,Y&Z cities, calculated @30,20,&10% of min pay of Rs.18000 – to benefit >7.5 lakh employee 7th CPC recommended revision of HRA when DA reaches 50% & 100%, Govt decided to revise rates when DA crosses 25% and 50% respectively.

3. Siachen Allowance: Rates of Siachen Allowance increased from Rs.14000 pm (Soldiers) to Rs.30000 & Rs.21000 pm (Officers) to Rs.42500 for extreme risk & hardship.

4. Dress Allowance: Government decided to pay Dress Allowance to Nurses on monthly basis due to high maintenance and hygiene requirements.

Higher rate of Dress Allowance for Special Protection Group accepted by Govt.

5. Tough Location Allowance: 7th CPC recommended-TLA not to be granted with SDA-Govt decided to give option of SCLRA at pre-revised rates with SDA at revised rates

6. Recommendations in respect of some important allowances paid to all categories:

Children Education Allowance increased from Rs.1500 pm/child (max.2) to Rs.2250/child and Hostel Subsidy increased from Rs.4500 pm to Rs.6750 pm

Special Allowance for Child Care for Women with Disabilities doubled from Rs.1500 pm to Rs.3000 pm

Higher Qualification Incentive for Civilians increased from Rs.2000 – Rs.10000 (Grant) to Rs.10000 – Rs.30000 (Grant)

7. Recommendations in respect of some important allowances paid to Uniformed Services: Defence, CAPFs, Police, Indian Coast Guard and Security Agencies

Abolition of Ration Money Allowance and free ration to Defence officers in peace areas not accepted, RMA to be credited in bank account

Technical Allowance (Tier-II) not to be merged, Govt. decided to continue Technical Allowance (Tier-II) @Rs.4500 pm-courses to be reviewed

Aeronautical Allowance increased Rs.300 pm to Rs.450 pm and extended to Indian Coast Guard also

Counter Insurgency Ops (CI Ops) Allowance for counter – insurgency ops increased from Rs.3000 – Rs.11700 pm to Rs.6000 – Rs.16900 pm

MARCOS and Chariot Allowance paid to marine commandos increased from Rs.10500 – Rs.15750 pm to Rs.17300 – Rs.25000 pm

Conditionality of 12 hrs reduced to 4 hrs for Sea Going Allowance and rates increased from Rs.3000 – Rs.7800 pm to Rs.6000 – Rs.10500 pm

COBRA Allowance granted to CRPF personnel in Naxal hit areas increased from Rs.8400 – Rs.16800 pm to Rs.17300 – Rs.25000 pm

Modified Field, Field & Highly Active Field Area Allowances increased from Rs.1200 – Rs.12600 pm to Rs.6000 – Rs.16900 pm.

Flying Allowance increased from Rs.10500 – Rs.15750 pm to Rs.17300 – Rs.25000 pm and extended to BSF Air Wing also

High Altitude Allowance increased from Rs.810 – Rs.16800 pm to Rs.2700 – Rs.25000 pm

Higher Qualification Incentive for Defence Personnel increased from Rs.9000 – Rs.30000 (Grant) to Rs.10000 – Rs.30000 (Grant).

Test Pilot and Flight Test Engineer Allowance increased from Rs.1500 / 3000 pm to Rs.4100 / 5300 pm

Additional Free Railway Warrant (Leave Travel Concession) extended to CAPFs.

Territorial Army Allowance increased from Rs.175 – Rs.450 pm to Rs.1000 –Rs. 2000 pm

Ceilings of Deputation (Duty) Allowance for Defence Personnel increased from Rs.2000 – Rs.4500 pm to Rs.4500 – Rs.9000 pm

Detachment Allowance increased Rs.165 – Rs.780 per day to Rs.405 – Rs.1170 per day

Para Jump Instructor Allowance increased from Rs.2700/3600 pm to Rs.6000/10500 pm

Govt. increased Special Security Allowance for Special Protection Group to 55% and 27.5% of BP for ops and non – ops duties

Housing provisions for PBORs and their families residing at other stations significantly improved and linked to HRA, process simplified

8. Allowances paid to Indian Railways

Additional Allowance increased from Rs.500 / 1000 pm to Rs.1125 / 2250 pm and extended to Loco Pilot Goods and Senior Passenger Guards @Rs.750 pm

Special Train Controller’s Allowance @5000 pm introduced for Train Controllers of Railways

9. Allowances paid to Nurses & Ministerial Staffs of Hospital

Governmentt increased rate of Nursing Allowance from Rs.4800 pm to Rs.7200 pm

Operation Theatre Allowance not abolished and rates increased from Rs.360 pm to Rs.540 pm

Hospital Patient Care Allowance/Patient Care Allowance increased from Rs.2070 – Rs.2100 pm to Rs.4100 – Rs.5300 pm

7th CPC recommendations modified and HPCA / PCA to continue for Ministerial staff

10. Allowances to Pensioners

Fixed Medical Allowance for Pensioners increased from Rs.500 pm to Rs.1000 pm

Constant Attendance Allowance on 100% disablement increased from Rs.4500 pm to Rs.6750 pm

11. Allowances to Scientific Departments

7th CPC recommendations to abolish Launch Campaign Allowance and Space Technology Allowance not accepted – rates revised from Rs.7500 pa to Rs.11250 pa

Professional Update Allowance for non-gazetted staff of DAE will continue at enhanced rate of Rs.11250 pa

Antarctica Allowance – Summer rates revised from Rs.1125 per day to Rs.1500 per day, Winter rates from Rs.1688 per day to Rs.2000 per day

12. Allowance paid to D/o Posts & Railways

Cycle Allowance not abolished – rates doubled from Rs.90 to Rs.180 pm for functional requirements of Postmen in Posts and Trackmen in Railways.

Source: PIB News